He unrolled the scroll and found the place where it was written: “The Spirit of the Lord is upon me, because he has anointed me to bring good news to the poor. He has sent me to proclaim release to the captives and recovery of sight to the blind, to let the oppressed go free, to proclaim the year of the Lord’s favour.” (Luke 4:17-19)

by Dave Krause

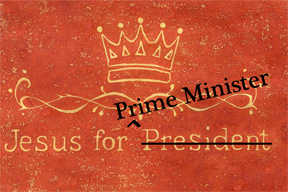

Recently, Brian Walsh reminded us that if we take seriously Jesus’ jubilee announcement in Luke’s gospel, everything must change. In fact, we will have to reckon with the notion that this Jubilee proclamation calls us to radically rebalance the ways in which our society see and facilitates the accumulation of wealth and power by the few to the detriment of the many.

Recently, Brian Walsh reminded us that if we take seriously Jesus’ jubilee announcement in Luke’s gospel, everything must change. In fact, we will have to reckon with the notion that this Jubilee proclamation calls us to radically rebalance the ways in which our society see and facilitates the accumulation of wealth and power by the few to the detriment of the many.

Those in our communities who are marginalized – whether by ethnicity, gender, location or socio-economic status – are to be prioritized. In this kingdom, the last shall be first.

This kingdom is not for the cleverest, the best-educated, the strongest, those that dress in the finest clothes or drive the fastest car – but the neighbour that the scriptures elsewhere calls the orphan, the widow and the stranger.

With that background, let’s focus our attention on the election chatter that has sprung up around the tax policy of Income-Splitting. This policy aims to allow a married couple with children under 18 to split or share up to $50,000 of their household income when they file their income taxes.

Such a proposal sounds attractive to families struggling in the aftermath of an economic downturn and whose jobs are lost or threatened, and savings ravaged. The truth is that such a policy skews strongly towards giving the greatest share of the purported average of $1,300 per family to the rich.

The households that stand to gain the most are those with a single income earner making close to $100,000 per year and those with a second income earner who makes a small percentage of the wages of the highly-paid primary earner. In such a case, think, for example, of a married mother who works part-time, and cares for her children for the majority of the time.

So, what do we make of this?

First of all, this doesn’t address the needs of the majority of two-parent families who since the 1980’s and 90’s, have increasingly had to rely on both partners working full-time jobs in order to maintain their finances.

As Ericka Stephens-Rennie points out, the greatest number of people in this group are the ‘middle-class’, those who don’t, in fact, have the $100,000 salaries to take advantage of such a ‘perk’.

Second, this does not deal with the situation of those single-parent families who face significant struggles under our current economic system and the political arrangements that enable it.

If we take seriously Jesus’ message to prioritize the needs of the ‘orphans, widows and strangers’, then we need to refocus the conversation upon those our system leaves behind, marginalizes and excludes.

That is, of course, if we have any room for the Biblical notions of shalom embodied in Jesus’ jubilee message.

Third, the current political rhetoric plays on some of our common fears and desires. We desire to be free from intrusive taxation. We are envious of those who we perceive to pay fewer taxes. We do not trust the aims of a redistributive society.

These fears play out even in our Canadian milieu, a society that has hardly the soul of equality, and over the past decades has steadily been engineered to be less so.

It’s not insignificant that gendered assumptions create one of the central tensions in this paradigm. The tension plays out specifically between women who work at paid employment and women who have made great sacrifices to work in the home.

Income splitting provides incentives for households with a dominant earning male and a female housewife, through targeted tax breaks. It does little on behalf of those who live in the reality of a financially pressured two-income household.

In reality, Income Splitting stands in the way of women who continue to struggle to gain the same employment opportunities as men. Additionally, it provides little practical support to those women who have to work out of necessity.

Finally, we need to follow the money.

Let’s put together the rhetoric around tax cuts for the dominant class (both individual and corporate):

- Attacking the deficit

- Cutting social spending for the vulnerable in our society

- Increased government spending on military force

- Coercive policing and the prison system

When we do this, we come to see that Income Splitting actually demonstrates a disregard for the health of what, in a biblical context, we might call ‘the household’.

This country has had one of the highest rates of growth in inequality in the last 15 years among all OECD states. This is in no small part due to our shifts in economic policy. We continue to lower taxation for those best positioned within our system all the while lowering spending for those whose position is not quite as strong.

Which leads me to the following conclusion:

The disproportionate allocation of a society’s resources to a privileged few, through the means of state and private power – is precisely what the Old Testament prophets railed against, precisely what the Jubilee measures were aimed at, precisely what Jesus preached freedom from, and precisely opposite to the way of being human that the Apostle Paul sought as he worked to create communities centered around the liberating narrative of the people of God and the ‘new Joshua’ we encounter in Jesus Christ.