by Brian Walsh

The political rhetoric is all so predictable.

The political rhetoric is all so predictable.

The Liberals or NDP announce some new policy initiative and the Conservatives cry that these initiatives will mean tax increases for “Ordinary Canadians.” The Conservatives announce some new policy and the Liberals and the NDP go on the attack because they can be traced, one way or another, back to corporate tax cuts.

You’ll remember that this election was called on the matter of contempt of Parliament and a key feature of that contempt charge was the government’s refusal to disclose the real cost of corporate tax cuts. But for a conservative, the question of the “cost” of a tax reduction simply has no meaning. The reply invariably is, “tax cuts don’t cost anything. They stimulate the economy, thereby making the nation economically strong.” The hidden assumption behind it all may just be that a stimulated economy results in an increase in other tax revenues for the government. People make more money and they buy more things, thereby leading to increased government revenue from increased sales and income taxes.

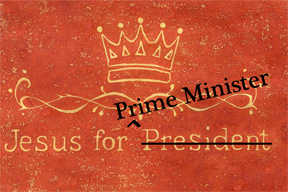

Now we’ll need to look at this whole tax thing a little more closely during this election, but we’re playing with the question of Jesus for Prime Minister. So we need to ask about Jesus and taxation.

Who would Jesus tax?

Would he tax anyone?

On first glance you’ve gotta think that Jesus isn’t all that keen on taxes. His experience tells him that taxation is a matter of the powerful and elite controlling and bleeding dry the vulnerable and poor. I mean, the man’s birth in a stable in Bethlehem was itself a result of oppressive tax laws, wasn’t it? Why did Joseph and his nine-month pregnant wife have to make that arduous journey from Nazareth to Bethlehem in the first place? Because of an imposed census. That census wasn’t interested in Stats Can kind of demographic information. No, this was a registration for taxation purposes. This was a means of imperial control over the wandering peasants and migrant workers looking for work wherever they could find it.

So the family stories about the birth of Jesus certainly wouldn’t dispose him favourably towards the taxation system of the Roman empire.

Nor would the way in which those tax revenues would be used correspond with a Jewish understanding of economic life or Jesus’ own emerging vision of the Kingdom of God.

Jesus says blessed are the poor, knowing full well that an oppressive tax system has made them poor.

Jesus says that he has come to set the captives free. Everyone would have heard many things in that proclamation including freedom from the captivity of Roman rule and Roman taxes.

Jesus declares that the incoming of his Kingdom was a favourable year of the Lord. The people would have heard that as a proclamation of the year of Jubilee – the year in which all debts are forgiven. In this vision of economic life, those who have benefited from an oppressive economic and taxation system will be required to relinquish their economic control in order to re-establish a level economic playing field.

When push comes to shove and someone asks him whether or not we should pay taxes to Caesar, he asks for a coin (since he obviously didn’t carry the stuff), looks at the image on that coin and says, “give to Caesar what is Caesar’s and to God what is God’s.” If Caesar wants this stuff then give it away, but recognize that God’s call on your life is much bigger, more profound and more radical than anything Caesar can imagine.

At first glance, Jesus seems to be negatively disposed towards taxation.

And yet he hangs out with tax collectors and other social outcasts. He fraternizes with the agents of this imperial taxation system. He welcomes them into his Kingdom movement and goes to their parties. And when they really start to figure out what Jesus is all about they begin to extend to others the generosity and welcome that they have received from Jesus, especially to those who they have oppressed through exercising their duly authorized taxation duties.

Zacchaeus was a chief tax collector and therefore was very rich. When he met Jesus (and Jesus invited himself over to Zach’s house for a party), he realized immediately what it meant to be in the presence of Jesus. “Look, half of my possessions, Lord, I will give to the poor; and if I have defrauded anyone of anything, I will pay back four times as much.”

In that first-century context in which taxation was a means of control and debilitating robbery of the poor by the rich, Zacchaeus understood that to follow Jesus is to redress the imbalance. His wealth beside the poverty of his neighbours can only mean one thing – injustice! Indeed, his wealth beside the poverty of his neighbours can only mean that he has defrauded his neighbours and must repay them generously in order to bring economic redemption to this situation.

So where is Jesus on the question of taxation? Let’s be clear, taxation that favours the rich and the powerful to the detriment of the poor is always unjust taxation. So any political party that advocates tax cuts for the rich in a society where there remain deep economic divisions between the very rich and the very poor is a political party that knows nothing of the way of Jesus.

When Zacchaeus met Jesus he not only abandoned the practices of an oppressive taxation, he engaged in a radically generous act of wealth redistribution. Giving away his wealth and repaying those who had been oppressed was an act of deep faith and profound economics.

At its best, taxation is a means of redistributing income to create a more level economic playing field. At its best, taxation is the way that we all contribute to the common good. In a radically individualist culture, the notion of something that is “common” is difficult to imagine. But if we root our lives in a commitment to love our neighbour, then progressive and responsible taxation could be one way that we seek justice and promote the common good.

For more on a Christian understanding of taxation check out the work of Citizens for Public Justice.

2 Responses to “Jesus and Taxation”

Pacifistic Redistributionism, Or, Things That Make You Go Hmmm… « The Righteous Investor

[…] opposed even to bringing social harmony through “…economic…power…”. And yet, here are some comments made about tax systems in the context of the recent Canadian federal election: So where is Jesus on […]